THE NORTHERN FORUM Cagayan Valley's Independent Newspaper

LATEST STORIES

-

Facemask policy indoors back in Tuguegarao due to COVID-19 uptick

-

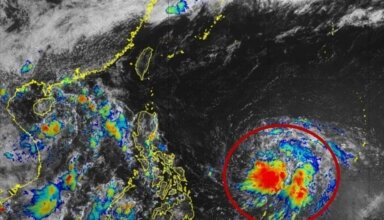

PAGASA monitors LPA east of Visayas; may become typhoon ‘Chedeng’

-

Increased volcanic activity in Mayon, Taal -Phivolcs

-

Slight drop in fuel prices expected this week

-

PAGASA: 11 to 14 typhoons expected to enter PAR this rainy season

-

Asuncion Restobar: The best Homestyle Cuisine in Tuguegarao City

-

Slight drop in fuel prices expected next week

-

PH Gov’t launches Super App for ‘faster, easier transactions’

-

Pagasa: Rainy season in PH may start next week

-

19 former rebels back in folds of gov’t

-

Wind signals lifted as severe tropical storm Betty exits PAR -Pagasa

-

Duterte turns down anti-drug czar offer anew

-

Controversial Maharlika Bill up for Marcos’ signature

-

PH outstanding debt hikes to P13.91 trillion in April -Treasury

-

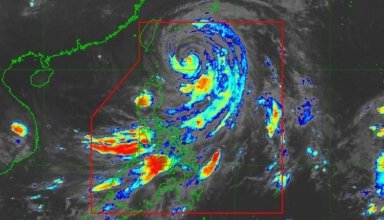

Signal No.2 remains in Batanes; Typhoon Betty slowly heads northwestward

-

Check out McDonald’s awesome ‘night classrooms’

-

Reward now P150,000 for info on suspects of college student’s slay

-

Over 1,000 evacuated in Cagayan due to typhoon Betty

-

Saudi Arabia eyes hiring about 1 million Filipino workers

-

440th Aggao Nac Cagayan month-long celebration focuses on “Unity”

-

Gasoline prices to climb starting Tuesday

-

Signal No.2 up in Batanes, eastern Babuyan islands due to typhoon Betty

-

Signal No.3 ‘possible’ in Calayan, northeastern Cagayan, Batanes -Pagasa

-

Cagayan, more provinces under Signal No1 as Betty moves westward

-

Cagayan ‘areas of concern’ bared as Super Typhoon Mawar nears

-

List of class suspensions in Cagayan, Isabela

-

More Omicron ‘Arcturus’ strain cases detected in PH -DOH

-

Super typhoon ‘Mawar’ may bring heavy rainfall over Cagayan Valley

-

Solano man arrested for alleged ‘sex blackmail’ against student

-

‘Mawar’ seen to gain more intensity, enter PAR today -PAGASA